COINBASE REVIEW

Rating

(96 User Ratings)

Currencies

Australian Dollar (AUD)🇦🇺

Available Cryptocurrencies

Available 100+ Cryptocurrencies

Table of Contents

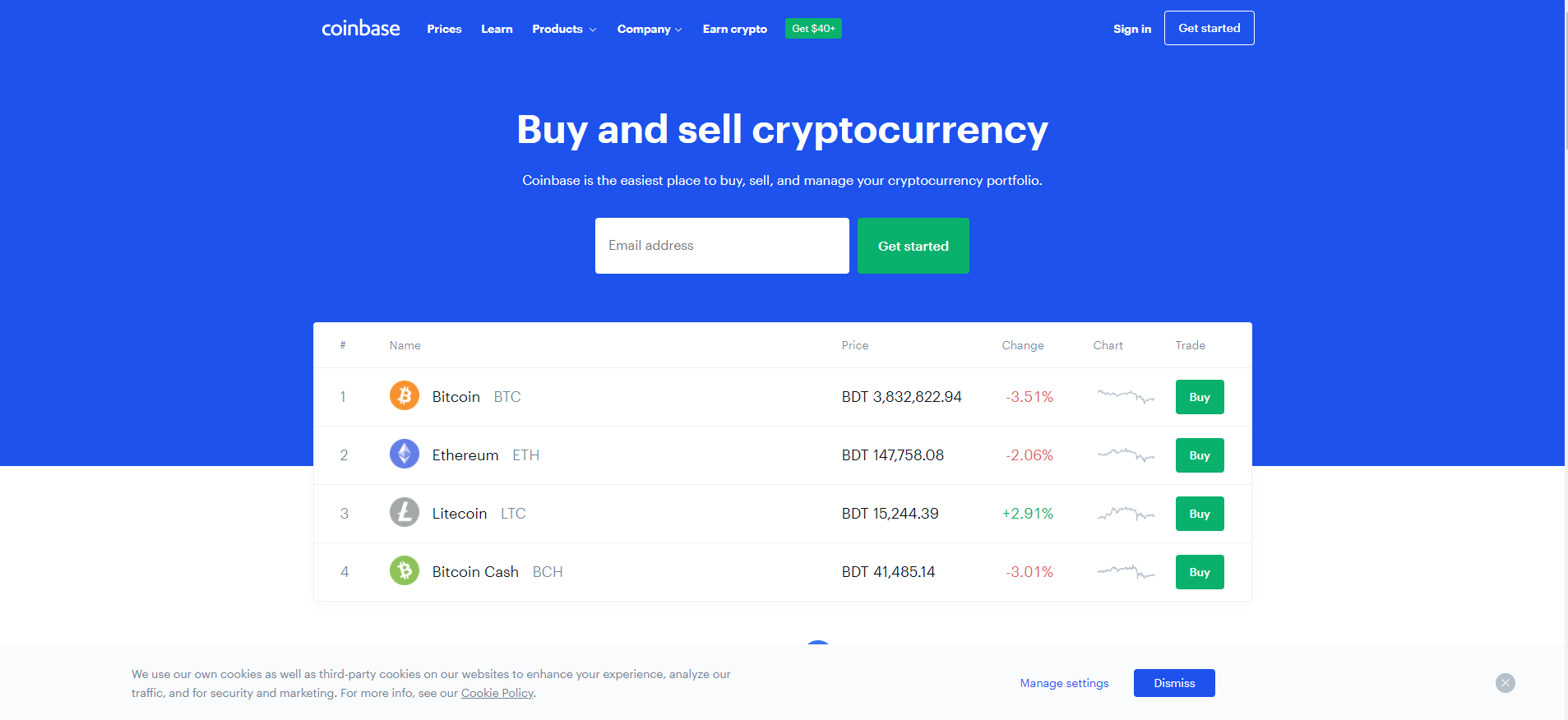

If you still have not tried purchasing and selling cryptocurrencies at Coinbase, now is the time. It is because, for the past eight years since it launched in the virtual currency scene in 2012, this private financial exchange has attracted nearly 15 million traders. And if you are not a part of this customer base, then, you must be missing out a lot.

Coinbase has plenty of trading advantages to offer if you are seeking the most secure and effortless way to buy and sell Bitcoin and other digital currencies. No wonder, it has earned its impressive reputation of being among the world’s well-received and popular cryptocurrency exchanges. If you feel getting gradually convinced with this brief introduction, carry on reading to discover more about what makes Coinbase among the best virtual currency trading platforms today!

User-Friendly Interface: Coinbase is known for its intuitive and user-friendly interface, making it accessible to beginners in the cryptocurrency space.

Wide Range of Cryptocurrencies: Coinbase supports a variety of cryptocurrencies, including major ones like Bitcoin and Ethereum, as well as a selection of altcoins.

Security: Coinbase has a strong emphasis on security, employing measures such as two-factor authentication (2FA) and cold storage of user funds to protect against hacking attempts.

Fiat Support: Coinbase allows users to buy and sell cryptocurrencies using fiat currency, providing convenience for those who are new to the crypto space.

Mobile App: Coinbase offers a mobile app that allows users to manage their portfolios and trade cryptocurrencies on the go.

Educational Resources: Coinbase provides educational resources, tutorials, and articles to help users understand and navigate the cryptocurrency market.

Fees: Coinbase is often criticized for its relatively high fees compared to some other exchanges, particularly for transactions using credit/debit cards.

Limited Advanced Features: While Coinbase is suitable for beginners, it may lack some advanced trading features that more experienced traders look for in other platforms.

Server Downtime: Coinbase has experienced occasional server outages during periods of high market activity, leading to disruptions and inconvenience for users.

Privacy Concerns: Coinbase has faced scrutiny for its data privacy practices, as it collects and stores user information, which may be a concern for those prioritizing privacy.

Limited Control of Private Keys: Users of Coinbase do not have full control over their private keys when using the custodial wallet, which goes against the philosophy of full ownership of one’s crypto assets.

Geographic Restrictions: Coinbase services are not available in all countries, limiting its accessibility to users in certain regions.

Beginnings and Profile of the Digital Currency Exchange

In June 2012, business partners Fred Ehrsam and Brian Armstrong opened Coinbase for business. They set up this digital currency exchange in San Francisco, California. Coinbase was first a platform that served as a straightforward way to sell, purchase, and transfer virtual currencies, especially Bitcoin. Then, over the years, it has expanded to provide a wide range of other services.

In November 2017, Coinbase declared that its client numbers had reached 13.3 million. Also, as of 2020, it has become the most trusted virtual currency exchange. Coinbase is available to traders in more than 55 territories. You can avail of its brokerage services if you are a resident of the United States, Singapore, Canada, and the United Kingdom. Plus, Coinbase serves many countries in Europe and North America, including the following territories:

- Andorra

- Austria

- Belgium

- Bulgaria

- Croatia

- Cyprus

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Gibraltar

- Greece

- Guernsey

- Hungary

- Iceland

- Ireland

- Isle of Man

- Italy

- Jersey

- Latvia

- Liechtenstein

- Lithuania

- Luxembourg

- Malta

- Mexico

- Monaco

- Netherlands

- Norway

- Poland

- Portugal

- Romania

- San Marino

- Serbia

- Slovakia

- Slovenia

- Spain

- Sweden

- Switzerland

As the largest Bitcoin broker in the world, Coinbase allows fiat on-ramps or the capability to avail of virtual coins using traditional fiat money. Therefore, you can buy cryptocurrencies using fiat money at the digital currency exchange, such as the following virtual coins:

- Basic Attention Token (BAT)

- Bitcoin (BTC)

- Bitcoin Cash (BCH)

- Cosmos (ATOM)

- Dai (DAI)

- Dash (DASH)

- Eos (EOS)

- Ethereum (ETH)

- Ethereum Classic (ETC)

- Litecoin (LTC)

- Ripple (XRP)

- Tezos (XTZ)

Moreover, Coinbase accepts the following deposit methods:

- Wire transfer

- Credit card

- Bank transfer (automated clearing house)

- Bank transfer (Single Euro Payments Area)

- Debit card

You can utilise fiat currencies like the US Dollar, Euro, and British pound as well. In 190 countries worldwide, Coinbase has Bitcoin transactions and storage. Plus, it recorded a revenue increase reaching US$ 1 billion in 2017. As you can see, Coinbase has been serving much of the world’s traders quite well when it comes to cryptocurrency trading. It truly has so much to offer, and you do not want to miss these benefits.

4 Advantages of Trading Cryptocurrencies at Coinbase

Coinbase has attracted millions of cryptocurrency traders, and it has made a mark in the digital currency trading scene over the years. Here are some of the perks that you will enjoy if you choose to trade in this established virtual currency trading platform:

Your cryptocurrency has insurance policy coverage.

If you choose Coinbase as your cryptocurrency exchange, you will benefit by having your Bitcoin, Litecoin, Ethereum’s Ether, Ripple’s XRP, or other virtual coins safeguarded by insurance. The digital currency exchange stores these virtual assets in their servers and insures them.

If Coinbase suffers a breach of its digital storage, the insurance policy will cover any losses caused by employee theft, or physical or cyber-security violation. This benefit would payout to cover your lost funds.

You enjoy safeguarded storage for your digital coins.

Coinbase keeps the huge majority of the cryptocurrencies in protected offline storage. This space for safekeeping offers a significant security measure against loss or theft. Also, Coinbase distributes Bitcoin in vaults and safe deposit boxes globally.

Coinbase has adopted the industry’s best practices to ensure the safety of their clients.

You do not have to worry about inside jobs when you engage in cryptocurrency trading at Coinbase. It is because this organisation requires its staff to pass a criminal background check, which is a mandatory measure during the employee recruitment process.

4.You can relish the easiest techniques of availing of Bitcoin.

As the world’s largest Bitcoin exchange, Coinbase has been well-received by traders for making the whole purchasing process of the world-famous cryptocurrency highly straightforward. The digital currency trading site has a simple interface. Therefore, you will find it easy to avail of the first-ever cryptocurrency in the world, especially if you are a first-time buyer.

As you can see, with Coinbase, seamless and secure cryptocurrency trading is within your reach. You really do not have to look any further. Try trading at Coinbase today, and you will surely feel that you have made the right decision.

4 Easy Steps to Perform When Starting to Trade at Coinbase

It is effortless to begin your trading journey at Coinbase. Also, you do not need to know a lot of technical details. Here are the easy-to-follow steps:

Step 1: Set up a Coinbase trader’s account.

You first need to register your name and e-mail address to get started at the digital currency exchange. Then, once you have supplied these pieces of personal information, you can log in to your trader’s account.

Step 2: Get yourself verified.

To begin selling or purchasing cryptocurrencies, you will have to get authenticated. You can perform this step by going to your account settings. Then, upload an image of the requested documentation. This credential can be your passport’s information page or your driver’s licence.

Step 3: Enable Two-Factor Authentication or 2FA.

The 2FA is a highly recommended safety and security measure. You can enable it by going to your account settings and following the given steps. The 2FA is an additional layer of security for your account. It is a code you will enter from your smartphone.

Step 4: Start selling and purchasing virtual currencies.

After you have performed the three previous steps, you are now permitted to trade the cryptocurrencies of your preference. Just go to the Home or Market Page. Then, click the virtual currency you want to avail of or sell.

These four easy steps will lead you to the best journey of trading Bitcoin and other cryptocurrencies. You really do not have to spend much time doing them because Coinbase understands that you are after the most optimal trading experiences fast and becoming both money and time-wealthy!

FREQUENTLY ASKED QUESTIONS

The widely used payment methods in the digital currency exchange are bank transfer, debit card, and credit card.

Coinbase has a 24/7 phone support centre. Plus, you can avail of their e-mail support. The Help section of Coinbase is also useful when getting assistance.

Yes, there is a Coinbase application. You can download it for Android or iOS.